A Plus / A+ International Health Insurance in China

You can get A Plus Health Insurance plans either if you are an individual or a corporate client. Headquartered in Hong Kong, since 2008 they have offered medical health plans around the world with a network of over 10000 doctors, hospitals and clinics under their direct billing list in more than 130 countries. Expatriates in China don’t tend to purchase much of their plans due to the fact that they do not have direct billing services with major international hospitals in Beijing and Shanghai.

They have one of the longest grace periods for submitting claims, up to 2 years from the day of treatment whereas industry average is more or less around 6 months up to a year. When it comes to health insurance for China, usually only Hong Kong nationals consider purchasing A+ China Expat Health Insurance plans as if they are looking for good services back home.

A+ Health Insurance Plans Overview

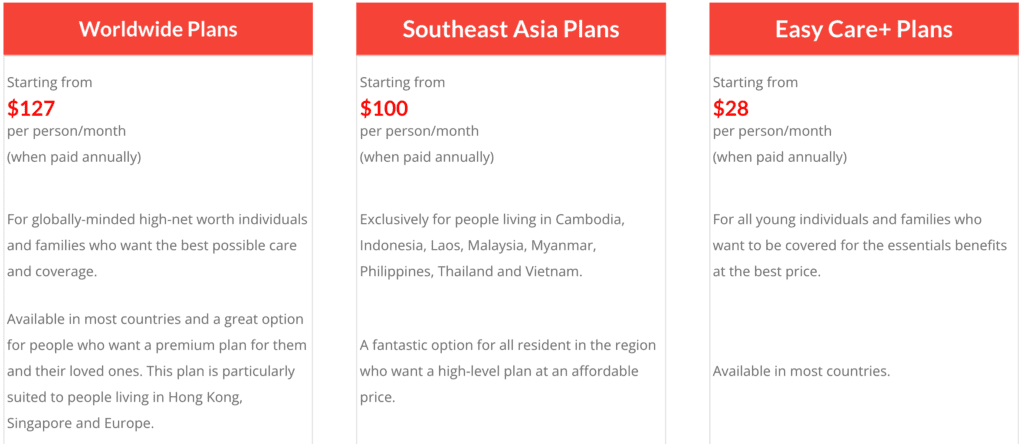

Although their global plans are in line with the market price for similar benefits form other providers, they do have quite interested tailored solutions covering South East Asia only, available for residents of that region excluding Singapore. Details below:

Key partners they rely on when servicing and underwriting their plans are AXA and MAI (Medical Administrators International), last one being the third party agent responsible for claims and direct billing under the plan. A+ is one of the very few companies that covers Traditional Chinese Medicines in full up to the limits of the plan. Most their plans don’t have limit on outpatient care which is what same clients prefer about them.

Key partners they rely on when servicing and underwriting their plans are AXA and MAI (Medical Administrators International), last one being the third party agent responsible for claims and direct billing under the plan. A+ is one of the very few companies that covers Traditional Chinese Medicines in full up to the limits of the plan. Most their plans don’t have limit on outpatient care which is what same clients prefer about them.

Major drawback of these plans is that they are not portable. Meaning, if you leave your place of residency, you cannot continue on the same level of cover elsewhere.

Source: A Plus International website aplusii.com