Summary on expat health insurance in China and all you need to know about it

- Find the right level of insurance you need.

- Make sure it gives you access to the right medical facilities.

- Deductibles, copayments or excess. Do you need them?

- Compare the insurance plans in terms of benefits included, services provided as well s prices.

We are a China based insurance broker with main aim to help foreigners and international Chinese to source, purchase and utilize health insurance plans in the country.

Types of expat medical insurance plans in China

Most medical insurance plans can be broken down into the following three categories:

Category 1: Core Benefits (inpatient only coverage) – this category covers only hospitalizations (overnight stays and longer), ambulatory care, evacuations. As well as other serious conditions and emergencies that will require you to spend at least one night in a hospital.

Category 2: Core Benefits + Outpatient Benefits – this category includes core coverage plus coverage for clinic doctor visits, prescription drugs. Certain scans like MRI’s, X-rays, day surgery, physiotherapy, chiropractic care, and other same-day doctor visits.

Category 3: Core Benefits + Outpatient Benefits + Premium (Optional) Benefits – this category includes all of the above + optional extras such as dental care (routine, complex and orthodontics). Preventative care is annual wellness check ups and vision care (glasses, eye checks). Last part is maternity (natural birth, C-sections, and complications of pregnancy).

As a summary

Inpatient Benefits = Hospitalization

Outpatient = Clinic doctor visits

Premium/Optional Benefits = Dental, vision, and maternity

Each insurance company has different terms and conditions. Generally, here are the benefits offered for each category to use as a guide for health insurance in China.

Inpatient Benefits: These benefits are for overnight hospital stays whether one day or several days and includes coverage for invasive surgeries. Things such as serious accidents or chronic medical conditions are also part of it. Inpatient coverage is a crucial component of any policy because the financial risk to you is very high.

Outpatient Benefits: These benefits cover visits outside of the hospital such as a doctor’s appointment, prescription drugs, physiotherapy, and minor day case surgeries. Example of day case surgery is a small surgery for a broken arm. Outpatient services don’t cost as much as inpatient, but with enough visits, they can break the bank. Which is why many expats in China carry outpatient benefits too.

Premium/Optional Benefits: These benefits are optional and are considered upgrades to inpatient or outpatient coverage. The benefits may include dental, vision, or wellness treatment and are a nice add-on. This will give you peace of mind whenever you need medical attention.

Maternity coverage is probably the most valuable of the premium benefits since many of the international maternity facilities like United Family Hospitals, Sino American, Parkway, OASIS will be charging around of RMB 80-90,000 for a routine birth. Cost are more than RMB 100,000 for C-section delivery. The coverage may also help with any complications at birth. It’s important to note that you must purchase maternity cover BEFORE you become pregnant. There is always a waiting period before maternity benefits begin, which is 6-12 months.

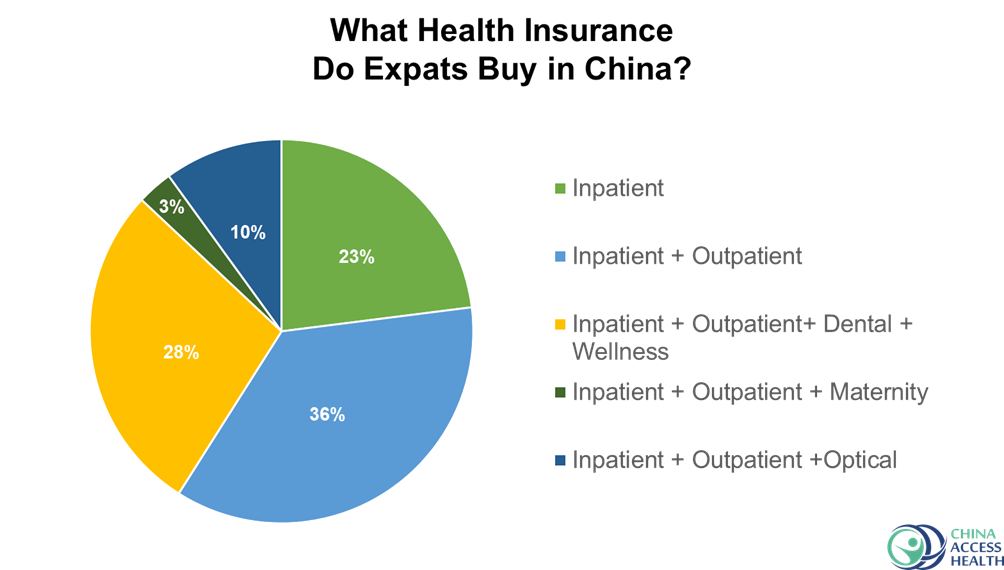

What level of insurance do foreigners usually buy in China?

Most expats in China (more than 77%) prefer a minimum level of health insurance cover at Category 2. Those include outpatient clinical doctor visits benefits. We’ve found that a smaller percentage (only 23%) of expats in China prefer Category 1 or hospitalization major medical insurance.

There is always a higher chance you will need to visit a doctor and get prescription drugs for a quick outpatient visit such as for a cough, cold, or skin rash rather than undergo inpatient surgery where you’ll be hospitalized for a few days or weeks.

Many people don’t realize that concerns such as a broken arm or leg are outpatient care in 95% of the cases. You visit the hospital, get an X-ray, get treated and go home. Only about 5% of cases have to spend the night in the hospital. This is why most expats select Category 2 benefits at a minimum.

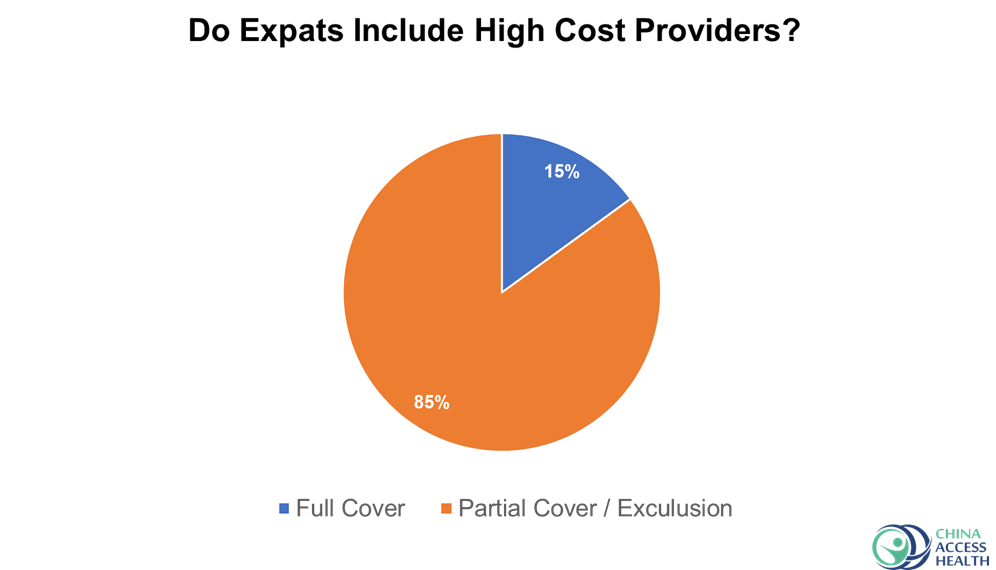

If I buy health insurance, which hospitals and clinics can I go to? Can I go to the expensive private hospitals?

Yes, you can go to ALL of them, but there are exceptions. You can have your plan adjusted to exclude certain higher cost medical facilities. If you exclude them, you may lower your premium because the insurance company won’t have to pay out the higher fees for the benefits at these facilities.

Another consideration when buying medical insurance in China is whether or not you want access to high-cost providers. As mentioned above, if you choose to limit access to certain hospitals and clinics which cost more you can drastically reduce your insurance premiums. But how popular is this option?

At China Access Health, we understand the importance of having access to the best facilities in China. We will review your policy with you and discuss your options for various medical facilities helping you choose the plan that provides the benefits you need at the prices you budgeted in mind.

Private hospitals in China are so expensive, which makes health insurance premiums expensive – are there any cheaper options?

We know how costly health insurance in China can be, so we work with you showing you all options to lower your health insurance premiums. We’ll focus on the high-cost medical facilities you won’t use and exclude them from your plan if needed. We can also discuss adding co-pays to your plan to lower your risk and therefore your premium.

Are deductibles and excess good for lowering premiums?

Given the popularity of high-cost provider co-payments, most people assume other co-payment and deductible options are popular too. This isn’t the case as only 3% of our clients choose plans with other co-payments or deductibles.

*Copayments refer to a certain % of the bill which members must cover themselves. For example, there are many options that provide full coverage for inpatient care but only 80% for outpatient care. For every outpatient bill a member has, they will pay 20% out of pocket.

**Deductibles and Excess in China are a fixed dollar amount members must pay before the insurance provider covers anything. For example, if a plan has a general RMB 10,000 deductible, the first RMB 10,000 of medical expenses are the member’s responsibility. The insurance company won’t cover anything until you pay your deductible. Deductibles and excess are on a yearly basis and usually per each insured person.

*** Certain companies have deductibles that can be applied to each outpatient visit. For example, Allianz has options for RMB 200 and RMB 400. This means every outpatient visit you must pay the specific deductible and then Allianz will cover the rest. These plans aren’t as popular because the savings aren’t very high.

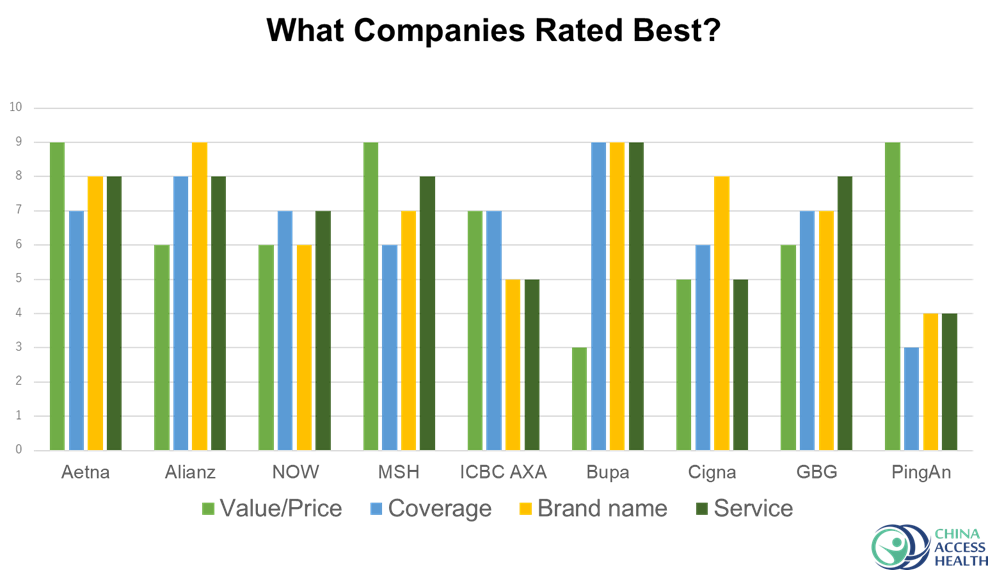

Which medical insurance plans are best in China?

We have scored the companies for major health insurance in China based on four factors: value over price, coverage, brand name and service.

The best three expatriate medical insurance plans in China are from

- Allianz Care

- Now Health

- Aetna

These are the three most popular choices among the clients we work with.

Over 60% of foreigners we meet choose one of those three insurance companies. There are exceptions, particularly if you want maternity coverage, need coverage for pre-existing medical conditions, or need worldwide coverage, which includes the United States. If we include MSH along with the other three companies, the percentage of our clients using the four firms would be close to 75%. Get in touch with us to learn more about China expat health insurance.

How to Choose Between the 5 Most Popular Insurance Companies?

Executive Summary

Allianz is best for young families, people looking for high service levels, families from overseas and elders.

Now Health offers the most comprehensive benefits at the lowest price. Their therapy limits are one of the highest on the market and their maternity (pregnancy) plans provide the most value for money with automatic insurance* for kids.

*Refers to coverage of children regardless of their medical conditions at birth. Only very few providers can cover congenital conditions, premature birth or other serious pregnancy complications.

GBG is great for US nationals who need cost-effective insurance that offers coverage in the US as well as those with pre-existing medical conditions as they do cover most of them.

ICBC AXA offers one the best value for the money for people looking for peace of mind and coverage only in China.

Aetna offers plans similar to ICBC AXA but with “Western approach” to treating clients.

MSH is one of the best direct billings* networks in China. They offer great maternity plans with automatic insurance for kids as well as many no critical pre-existing medical conditions plans.

*Direct billing refers to cashless payment where the insurance provider settles the bill without your participation. Usually, it only requires you to present your medical card upon admission to outpatient care.

Here are the pros and cons for the major medical plans for expats in China.

Allianz

Allianz is of the most reputable and oldest insurers in the world. They offer the fastest claims turnaround as well as adjustable plans in terms of deductibles. Allianz is also one of the very few companies that has benefits for none-prescribed physiotherapy. Their dental plan is one of the best on the market, with an RMB 15k limit per policy year. They are also very price-stable, with an average premium increase of around 6% over the past 7 years. Allianz plans are portable* to any country except the US, Germany, and Switzerland. The company has a mobile app and portal for managing your policy.

*Portability refers to insurance provider’s capability to transfer your plan overseas. This provides continuation of coverage, so if you get a plan from Allianz in China and in few years relocate to Singapore, they will be able to switch you to a new plan without cancelling your current plan. This ensures all pre-existing conditions continue to be covered.

There are two downsides to consider too. Wellness checkups as an optional upgrade don’t make sense if you’re over 43-years old. Adding an RMB 6k wellness limit will increase your premium by RMB 5k. Also, Allianz is one of the most expensive providers.

Now Health

Now Health is not one of the traditional powerhouses, which discourages some people. However, their coverage is excellent. If you are more concerned about coverage for therapies, such as regular physio sessions for your lower back, consultation with a psychiatrist, or even alternative therapy sessions, Now Health has one of the highest limits for you and your family.

The outpatient coverage is also up to RMB 22-28 million, which is one of the highest in the market. If you or your kids needs orthodontic care, Now Health is one of the top picks along with Allianz due to the high benefit limits on dental care. The company offers many plan adjustments, with deductibles and co-payments. Their plans are also portable to any country except the US, Germany, and Switzerland. The company has a mobile app and portal for managing your policy.

The downside to consider is that they price based on age groups. If you turn 45 or 50 this year, you are in a higher age band and your premium increase might be quite hefty. Around 13%-16%. They also have one of the largest high-cost provider lists on the market. Places like Sino United or Global Health Care in Shanghai and OASIS in Beijing are high cost for them while not for many others.

Aetna

The Aetna Comprehensive plan is one of the best value-for-money options available. It includes dental and wellness benefits without the need to pay extra, while costing the same as competitors who do not offer that option.

Aetna has one of the largest hospital networks worldwide (in the US they use the Aetna US network). Price increases have been very stable too. For example, in 2020-2021, their premium increase was one of the lowest in the market at around only 1.5%. They have a very user-friendly online portal, as well as one of the best direct billing networks in China.

There is a downside, though. Although Aetna is a global company, their plans are not portable to any country. Once you relocate out of China, you will have to apply for a new plan as a new member. The plan is also quite expensive for single-parent families as they are priced the same as a two-parent family.

ICBC AXA

ICBC AXA has similar plans to Aetna and offers a good value for the money. The company provides vaccination benefits for kids by default under its comprehensive plan, with no need to pay extra.

On the downside, their plans are focused on China, with no network of hospitals outside the Greater China region. They offer no portal or app for managing the policy, other than an official account on WeChat. As the mobile features are designed for Chinese users, complications can arise with even simple things such as entering Western names into the system.

MSH

MSH’s China Expat Insurance (CEI) plan was launched at the end of 2020 and has already become one of the most cost-effective solutions for outpatient coverage due to its pricing.

MSH does not sell this particular plan to local clients, focusing exclusively on the expat market. The MSH Premier plan is one of the best solutions if you plan to start a family and need protection for your child from Day 1 without any medical underwriting. This plan is also one of the very few policies on the market if you are looking for coverage for pre-existing conditions.

MSH offers both a mobile app and portal, as well as an excellent direct billing network both in and outside of China. Plans are also very price-stable, as the company tends to keep your premium at the same level as the preceding year if you meet the requirement of “low claims” (usually less than 20% of the policy premium).

On the downside, the CEI plan does not provide any mental health benefits. These benefits are only available with one of the upper-tier plans, such as Advance or Premier. All plans also have a sub-limit for physio sessions starting at RMB 1,200 per visit, which won’t be enough for several private facilities such as Parkway where one physio session is priced at RMB 1,400 and above.

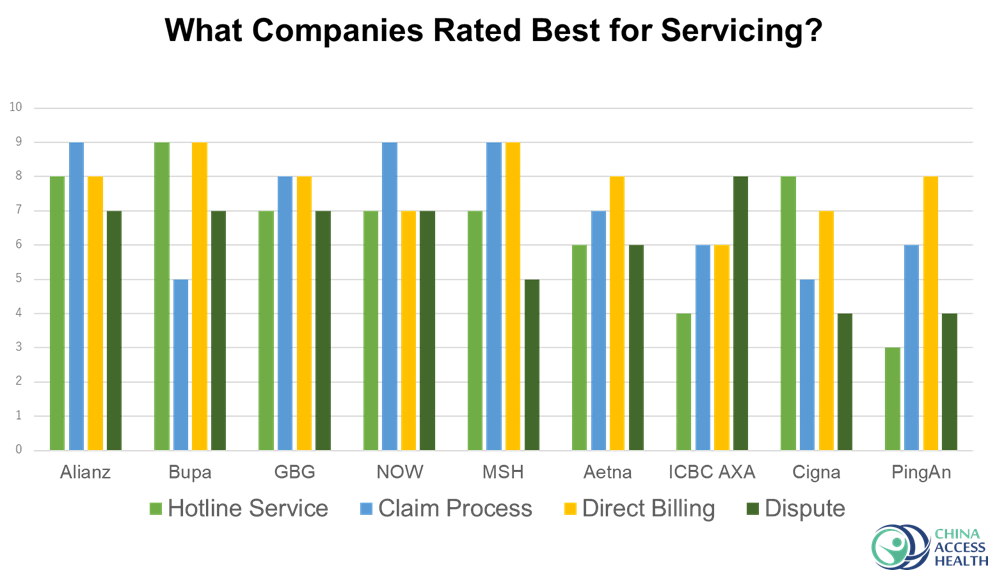

Many people don’t realize that your satisfaction with a healthcare plan is highly dependent on the quality of the insurance company’s services. Your family can have a great plan, but if there are always problems using the insurance, or claims are paid incorrectly, it can be problematic.

The information below will teach you about the various price vs. service trade-offs. We will explain which health insurance companies in China offer good value and which you should avoid.

What are the most important services for a family insurance plan?

Before we compare service levels among insurance companies in China, you need to know which metrics we considered. There are hundreds of ways to measure service levels. However, we find that the most common and important areas which need to work well are:

- Hotline Service

- Claim Process

- Direct Billing

- Dispute Resolution

Dispute Resolution

Even with the best insurer, sometimes things go wrong. But if you are with the right insurer and broker, any issues or errors can usually be resolved very quickly and avoided in the future. The ability to resolve problems when they arise is possibly the most important thing we look at when advising on insurance plans for our clients. You want your long-term insurance partner to be accommodating and understanding, not belligerent and inflexible.

As an example, ICBC AXA and GBG are exceptional at resolving issues or disputes. Their attitude towards our clients and us has been very positive and cooperative. This is partly owing to our close relationship with their senior management.

Hotline Quality

The first port of call for most people when interacting with their insurance company is either calling the 24/7 hotline or emailing their service team. You might need to check if a particular treatment or clinic is covered under your plan or follow up a claim. Either way, the hotline is essential. A good hotline will understand what you want, provide helpful information, and resolve your query fast. If a hotline doesn’t function correctly, simple tasks can become unnecessarily complex.

Bupa has the highest quality hotline, and this applies worldwide. Even if you are in a foreign country and need help in the middle of the night, Bupa’s concierge service will connect you with local network contacts to guide you through any issues.

Direct Billing

Direct billing refers to cashless services at network hospitals and clinics. Put another way, it is when you get treatment at a medical provider within the insurance company’s network, and you don’t have to pay anything — they simply bill the insurer.

This is one of the most critical services an insurer can give, and it comes standard with most insurance plans in China. It means you can avoid applying for those pesky claims reimbursements which involve a lot of paperwork. Just make sure you and your family bring your medical cards when getting medical care, to ensure that the direct billing takes place.

When examining if an insurance company’s direct billing services are good or not, there are two criteria:

- Is the hospital network large and does it include the hospitals or clinics you’ll use?

- Are there any coverage benefits which are not included in their direct billing services, such as dental or annual wellness check-ups? This is important as many insurance providers have different direct billing lists for different types of treatment. While you will find that some companies have over 45 medical facilities in Beijing for outpatient cashless services, in many cases their lists for dental care will be much less extensive. If a clinic accepts direct billing for outpatient care, that doesn’t often mean that they’ll accept the same for dental care, even if their dental department is right next door.

Making a Claim

If you find yourself outside of the insurance company’s hospital network, or direct billing isn’t provided for that type of treatment, you must pay first and then make a claim for reimbursement. Making a claim is everyone’s least favorite part of using medical insurance. Some companies pay their claims fast and proactively help you make a successful claim, while others can take weeks to process a claim only to come back and tell you that you’re missing some information, or they reject the claim without clearly explaining why.

Allianz has by far the fastest claim turnaround time of any insurance company on the market – over 95% of claims are paid within 48 business hours.

Most insurance companies support online submission of claims. Allianz, MSH, Aetna, and Now Health have online portals where claims can be submitted. However, ICBC AXA, PingAn, AXA TianPing, and GBG only have this function through their WeChat official accounts. Some companies like Allianz, Now Health, and MSH even have apps for both IOS and Android.

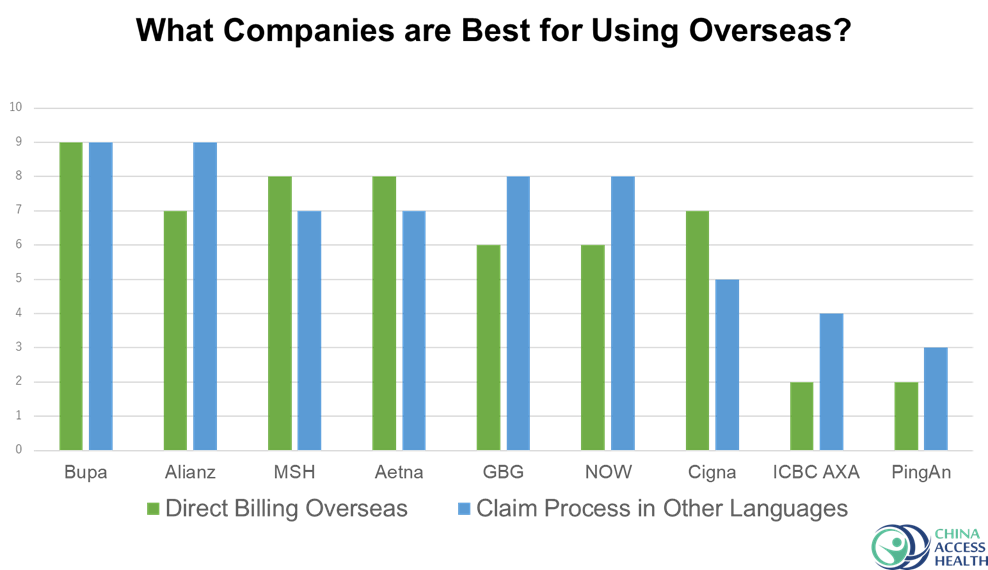

Overseas Service Standards

Another thing to consider is whether or not you will need to use insurance or have coverage for when you are outside of China, for example on holiday, business travel, or back in your home country.

Different insurers have vastly different service standards when using insurance overseas. A good example would be ICBC AXA. They provide a solid service proposition in China; however, using their insurance outside of China can be difficult. In contrast, higher-cost insurers who are more international, such as Allianz and Bupa, provide great service both within and outside of China.

Let’s look at these service elements in more detail.

Strength of the insurer’s overseas hospital network

No matter where you and your family are in the world, your insurance company should be able to arrange a direct settlement with a hospital in the event you need inpatient treatment or need to be hospitalized.

Some insurers will even be able to offer direct billing for outpatient treatment in many countries throughout the world. This isn’t the case for all insurance companies, so if you do not want to be responsible or large amounts of out-of-pocket expenses, ensure your insurance plan work well overseas.

Can You claim documents written in other languages?

You may not think about needing coverage in other countries, but if you travel, it’s an important aspect when looking at health insurance in China.

Imagine this: You go on holiday to France, and while there you trip and break your arm. You go to the emergency room, get treated, and pay for the treatment. However, when submitting your claim to the insurance company, instead of processing it as normal, they ask you to arrange for it to be translated before they’ll examine the claim. In addition to being a huge annoyance, this will also cost you money.

The moral of the story is: If you spend significant time outside of China, particularly as a family, ensure your insurance plan will work well overseas.

Ability to Advise You When Seeking Treatment Overseas

Bupa has an international concierge service designed to help you when you travel. One of our clients, while travelling in Vienna, had a pregnancy-related emergency in the middle of the night. They called the Bupa concierge hotline for emergency assistance, who transferred them to their European call center, who directed them to the appropriate maternity hospital and even managed to arrange direct payment for the treatment on short notice. Wow! Very few insurance companies have this high level of service.

Value Added Services

Basic service levels aside, the ultimate insurance company comparison wouldn’t be complete without information on each insurance company’s value-added services. These services can be very important to people who are older and nearing retirement, or who are long-term expats in China who may in the future move to other countries.

Lifetime Renewability

For anyone nearing retirement, one important consideration is whether the insurance company offers lifetime renewability. Some plans do not allow people above the age of 65 to renew their insurance. A good rule of thumb is if you’re 60 years old, you shouldn’t buy a plan which doesn’t offer lifetime renewability.

The below insurance companies offer lifetime renewability:

- Allianz

- Bupa

- Now Health

- Aetna

- AXA Tianping

- GBG (if enrollment was before the age of 60)

- MSH (if enrollment was before the age of 60 or 64, depending on the plan)

Portability

Portability refers to the ability to take your insurance plan with you when you move to another country – or to have the option of moving on to an alternative plan suitable for the new country without having to go through the underwriting process again.

This is very important if you are a long-term expat. As you age, you’re likely to experience more medical conditions and illnesses. You don’t want them to become pre-existing conditions on your new plan, as this may prevent you from getting coverage for them or result in coverage denial.

Having an insurance plan with portability will ensure you can keep your coverage as you age and move around the world with your family. The below insurers have some level of portability on their China insurance plans:

- Allianz

- Bupa

- Now Health

- GBG

- AXA Tianping (limited to certain countries)

What About local Chinese insurance companies?

You may have noticed that except for Ping An Health we haven’t mentioned any other local insurance companies such as China Life, Zhong’an, PICC, etc., or other foreign-branded insurance companies such as Citic Prudential and AIA.

We have good reason. Some local and foreign-branded medical insurance plans don’t offer true insurance coverage. They have no qualms about not allowing you to renew your insurance if you get cancer or submit substantial claims. They have been known to cancel the contract or product to avoid payouts.

Can you imagine being diagnosed with cancer and the insurance company not allowing you to renew the plan, so they can avoid paying for it? We have had individuals come to us with these scenarios.

If a plan is very cheap, it is cheap for a reason. If it’s too good to be true, then there’s usually a catch that you can’t see. This is another reason why having an experienced, reputable broker is essential.

We can’t stress enough: DO NOT buy a plan simply because it’s the cheapest without checking the company’s history and reputation. Health insurance for expats in China is a wide topic to cover by yourself, get in touch so we can help find what’s the right plan for your situation.

Other interesting content

Health insurance in China for foreigners costs

English speaking doctors in China

How to cover pre existing medical conditions?