William Russell China health insurance for foreigners.

William Russell supplies global market with plans since 1992. Originally out of UK they have regional office in Hong Kong and Thailand to service Asia-Pacific region. In this article we will cover general introduction to William Russell health insurance plans.

Although you will not be able to enjoy much of direct billing services with William Russell health insurance plan in China. Their plans would probably be among top 5 most comprehensive ones with many benefits fully covered. This refers to under the overall limit of the insurance policy and not separate sub-limits. Higher level of medical protection also has a big impact on the premium side. Especially for members over the age of 50. Premium loading on health insurance in that case is quite significant and is much higher than industry average among other insurance providers. They are however somewhat flexible on enrollment. For instance, they can let you split the policy between family members, some on a more comprehensive cover level while some on more basic.

William Russell offers one of the best direct billing services in Hong Kong and Thailand. Apart from those two markets, expenses in other places will have to be on a pay and claim basis. Where member has to carry those out of pocket and then submit all the documents together with claim form for reimbursement. Claim reimbursement is usually processed within 5-10 working days. Of course depending on the complexity of the medical records and language they are in.

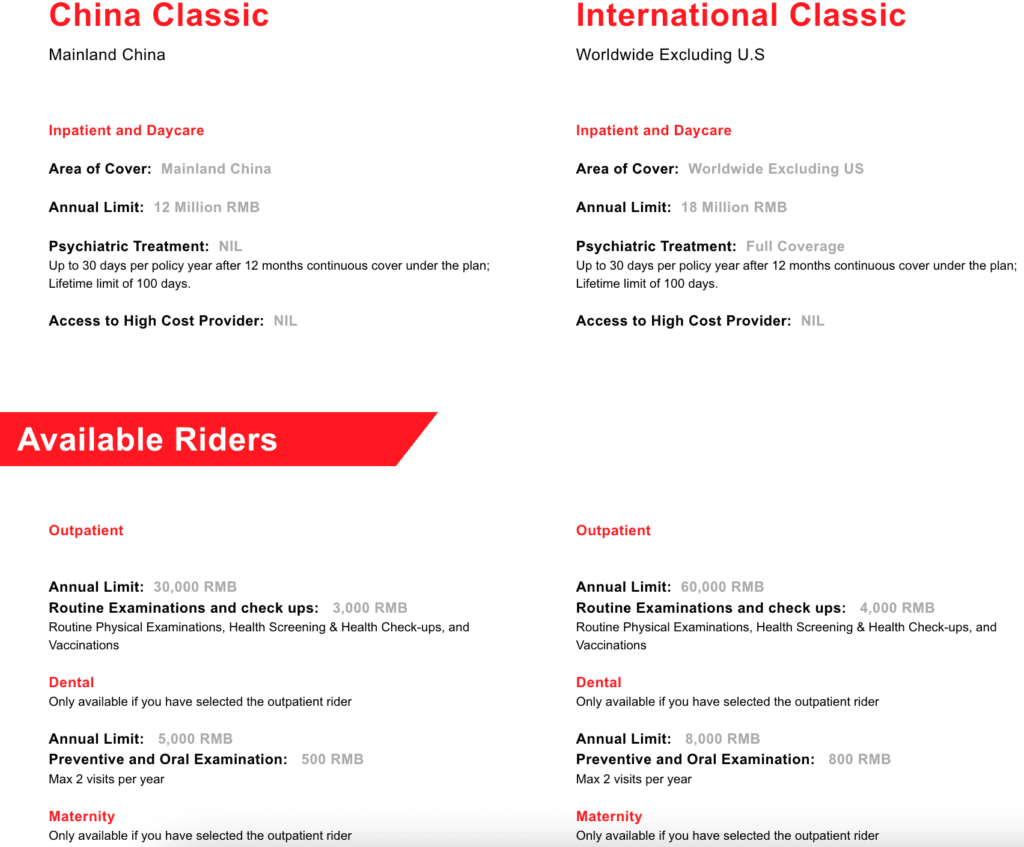

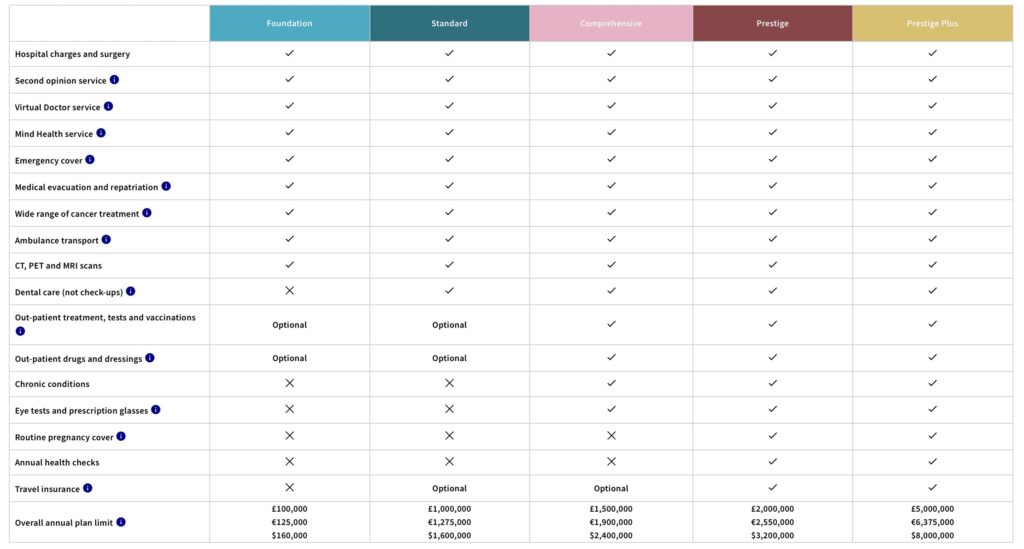

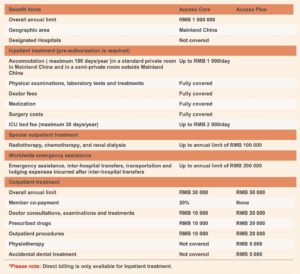

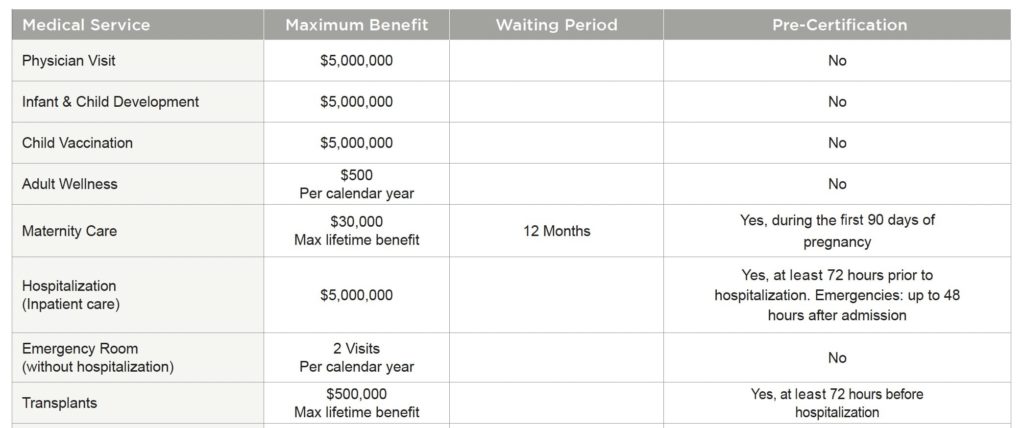

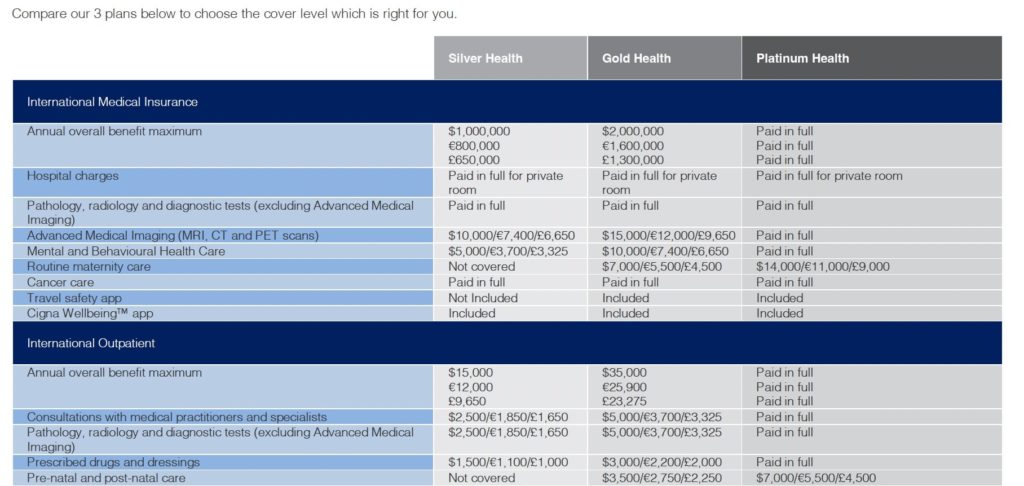

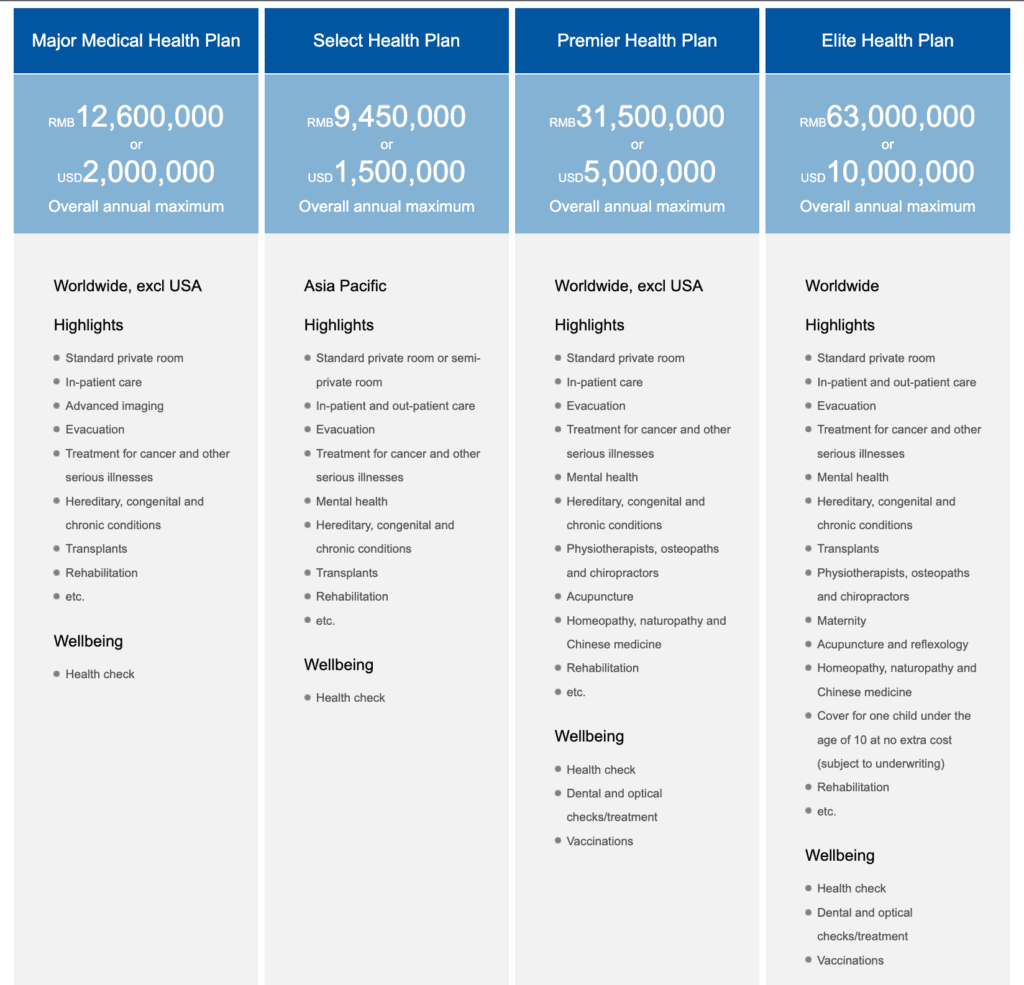

William Russel Health Insurance Overview

Below you will find general summary of William Russell health insurance policies. Please get in touch with us if you re interested to learn more about health insurance in China. Additionally, what plans might suit your unique situation best.

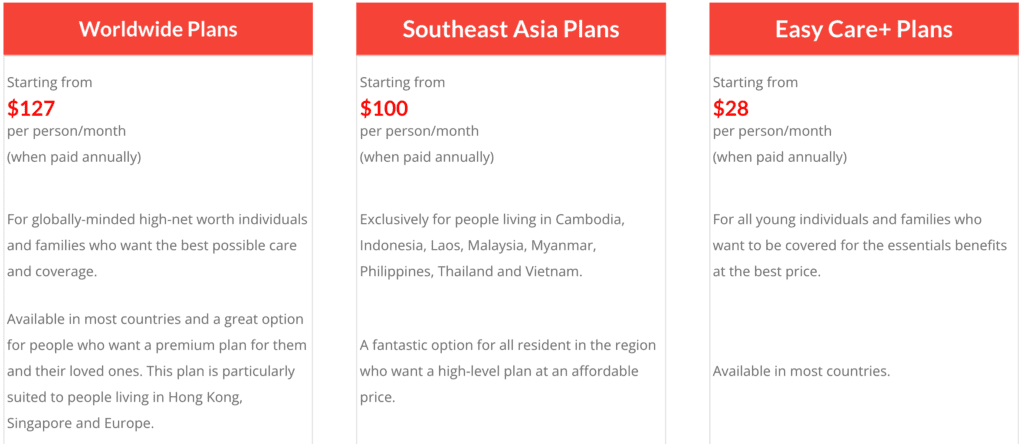

In 2022 they have launched a more basic version of plans for South East Asia residents. This in particular comes handy when you don’t need millions of $ on cover. But rather enough for several hundred of thousands.

Source: William Russell Website

Here you will find general list of international hospitals in China

More information regarding health insurance in China and how to choose the best one

Key partners they rely on when servicing and underwriting their plans are AXA and MAI (Medical Administrators International), last one being the third party agent responsible for claims and direct billing under the plan. A+ is one of the very few companies that covers Traditional Chinese Medicines in full up to the limits of the plan. Most their plans don’t have limit on outpatient care which is what same clients prefer about them.

Key partners they rely on when servicing and underwriting their plans are AXA and MAI (Medical Administrators International), last one being the third party agent responsible for claims and direct billing under the plan. A+ is one of the very few companies that covers Traditional Chinese Medicines in full up to the limits of the plan. Most their plans don’t have limit on outpatient care which is what same clients prefer about them.