What is preventative care?

The purpose of preventative care is to help a person deduct any potential abnormalities in their health at early stages, in many cases, before symptoms actually develop. This article will guide you through the preventative care raider on health insurance plans, how to check if you have these benefits already and if in general it worth to include it.

First of all let’s figure out what is preventative care. Most insurance companies will already have wellness raider “built into” the plan. Others will have it as elective, meaning you can pay extra and get it into your policy. Preventative care refers to something that you can use without necessarily being sick.

The following treatments are usually classified as preventative care under insurance policy. Routine health checks, preventative immunizations and eye checks. Insured member can decide to do an annual health check without having initial symptoms to consult on. If you have certain symptoms or discomfort, such consultations usually go as part of general outpatient benefit.

How can you check if your plan includes preventative care?

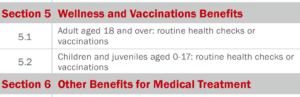

For that you will need to refer to your wellness raider. This is a general rule of how insurance companies list preventative care under policy structure. Number one step is to check your actual table of benefits. Entire policy structure with limits is on it. Example below.

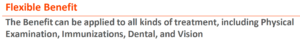

This will clearly state what the benefit can be used for as well as what limit do you have. Most insurance companies in China have limits that apply per policy year. So when you renew your plan next year, limit will be renewed as well. Example above lists that only check ups and vaccinations are covered under this raider. So if you do decide to go for a check up with ophthalmologist, this will be billed separately. There are insurance companies that can have vaccination benefits as a separate limit. Particularly for plans designed for kids. In some cases all of preventative care can be under the same limit as example below.

Does it worth to include preventative care?

If your health insurance doesn’t include wellness raider, there is a chance it goes as an optional add on. Surprisingly, extra costs for those is higher for adults than for kids. This is a case of most insurance plans in China. So does it worth including preventive care in your China expatriate health insurance?

In general, adding these benefits in terms of “value for money” is not great. Companies follow a rule where benefits vs extra costs ratio is 1:0.8. For instance, if you add RMB 2,000 wellness benefits, you should expect to pay around RMB 1,600 on your insurance premium. Reason for this is because insurance companies consider preventative care as claims that will definitely occur under each policy. You don’t have to be sick to use it, so why not use all of it, right?

In conclusion, if your insurance plan already has wellness benefits then it is no subject to any extra costs. You are good to use them every year as limits will be renewed on each subsequent renewal of your insurance. On the other hand, it does look like adding these benefits as extra will not be a good option. But hey, we all need annual medical. And if we all do it every year for RMB 3,000, why not pay RMB 2,600 for it. Saving RMB 400 has not hurt anyone yet.