Contact GBG

- GBG Health Insurance Department 24 hour helpline toll free in China: 400 8169300

- 24 hour helpline outside of Mainland China: +1 905 6694920

- Email: chinaservice@gbg.com

- Claim address:

Contact the emergency services

- Call an ambulance: 120

- Call the fire department: 119

- Call the police: 110

Download useful information

There is an option to tailor GBG Health insurance plans to provide cover in public (government run) hospitals only. Alternatively, you can still include access to international medical facilities with English speaking doctors in China too. Most importantly, always make sure what level of access to providers you have.

How to make a claim

- Once you receive medical treatment please ensure that hospital front desk gives you a chopped/stamped medical fapiao (can be e-fapiao), medical reports including diagnosis and list of prescribed medications

- If available you can submit your claim via the insurance company’s website or app from your smartphone. For instance, they support both iOS and Android, as well as WeChat official account.

- Firstly, download a claims application form form the ‘Download Useful Documents’ section of this page and complete the form as best you can.

- Secondly, scan and send all documentation including the claim application form to chinaservice@gbg.com

- GBG insurance company will then confirm that all documentation is in order and will ask you to submit the original claim documents to the insurance company if needed. Generally speaking, if it is a non-China claim scanned copies may suffice.

- Lastly, insurance company will email you the claim application result and will reimburse eligible claim amounts to you bank account.

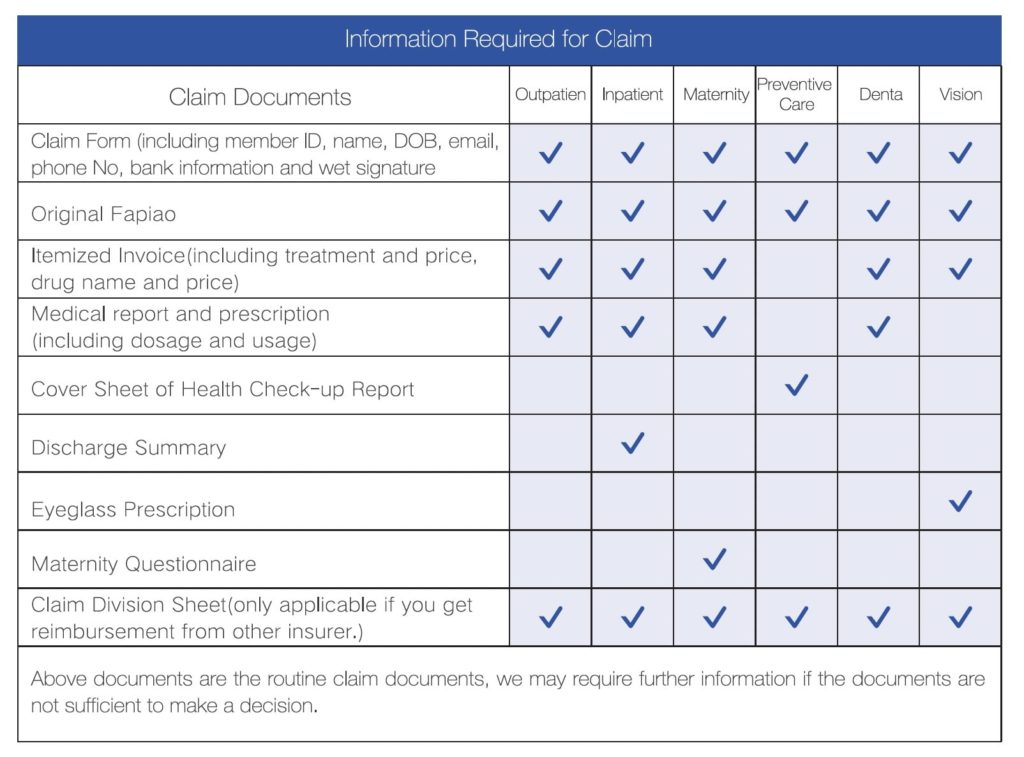

Below is a handy summary on what information you need to collect for different claims under GBG Health insurance plan.

GBG Health Insurance Claim

Pre-authorization list

Please apply for pre-authorization with GBG Health Insurance Department or through the service hotline 48 hours prior to the acceptance of the following treatments:

- Hospitalization – need Pre-Authorization is for all locations. (Incl. Hospital stay for Maternity / Delivery)

- Outpatient Surgeries requiring general anesthesia.

- Private Duty Nursing – (When 4 or more visits will happen)

- Organ, Bone Marrow, Stem Cell Transplants, and other similar procedures

- Air Ambulance – Air Ambulance service will be coordinated by Insurer’s air ambulance provider.

- Any condition, including cancer treatment or any chronic condition, which does not meet the above criteria. But will accumulate to over ¥60,000 of medical treatment per policy year

- Hospice care

- Pre-Authorization through GBG Assist if you have a medication that will exceed $ 3,000 / CNY20,000 per refill