Giving Birth in China as a Foreigner. Insurance vs Maternity Packages

This article will only cover health insurance plans that cover maternity benefits for giving birth in China as an expat, overview of those hospitals that are fitted to support giving birth as well as how all of it is different if you simply purchase a maternity package from a medical facility.

Having baby in China as an Expat – First Steps

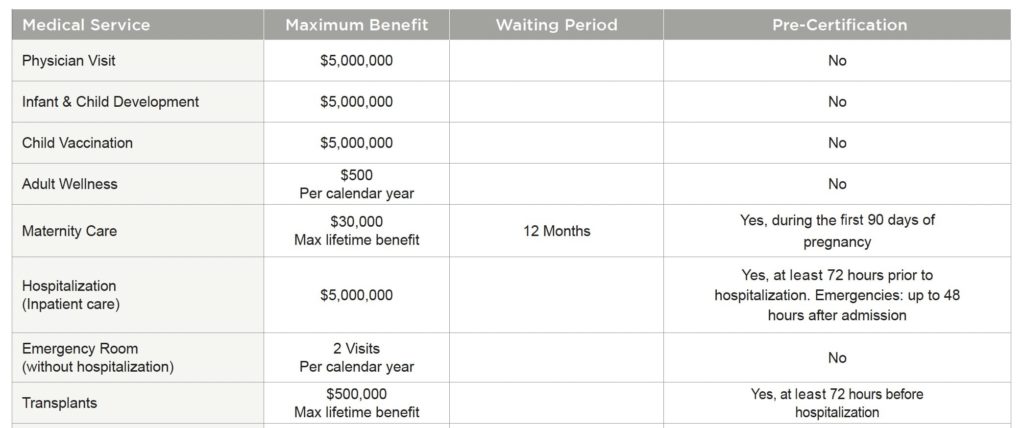

First of all, it worth mentioning that if you are looking for expat health insurance in China to cover medical expenses associated with giving birth, most of those should be purchased in advance. As of January 2020 there are no insurance plans in China that you can purchase if pregnant already. Last option was MSH but they cancelled that plan. Right now most of them will have a minimum waiting period of 6 months and a maximum of 12 months.

Needless to say, all other insurance benefits except maternity is not subject to this waiting period. Meaning, if you get cough, cold or need some physiotherapy for instance, plan will cover it. Maternity waiting limit applies separately. There are however some maternity insurance options that will cover pregnancy expenses from day 1. However, member can’t be pregnant at the point of purchasing a plan. You can get pregnant right after and then costs will be covered during the 1st policy year.

How much does it cost to give birth in China?

Giving birth in a public hospital in China as a foreigner will cost you around RMB 2,000 and RMB 8,000. In those you will have an option to go through VIP or International section, in that case costs will jump up towards RMB 25,000-30,000 mark. While giving birth in private international type hospitals in China will be around RMB 60,000 in costs. Complications, such as c-section, will typically cost twice as much compared to traditional delivery.

Is it free to give birth in China?

Costs for child delivery can be compensated for employed expats in China only as long as they have social insurance through their employer. Keep in mind that this will only be applicable to public government run medical facilities. Not even VIP or International section. For anything extra than that, foreigner shall purchase private medical insurance and opt for international type hospital.

Waiting periods for maternity insurance plan in China

Pay attention to the wording of the waiting period under your insurance plan. In other words, exact definition. Most of insurance plans have general waiting period. Let’s take for example 12 months. That means a person can get pregnant before waiting period is over, but you can only claims expenses that happen after 12 months. If you have such a plan then ideal scenario is to get pregnant towards the end of the first policy year. Thus, first ultrasounds and child delivery itself during second policy year can be covered.

Some insurance companies have a “no pregnancy waiting period”, usually those that have a 6 months time restriction. That means that pregnancy should only occur after 6 months once you purchase a plan. Treating doctor will have to confirm on medical records when pregnancy first occurred. Get in touch with us to lear more what maternity plan might suit your situation best. We will make sure you can go for child delivery in hospital of your choice.

Are fathers allowed in the delivery room in China?

Males are typically not allowed in the delivery room. There is, however, an option with several public hospitals to opt for that option for some extra costs. On average, those will be RMB 3,000-5,000. On the other hand, they are ok to accompany female during pre and post natal care.

I am pregnant already, what are my options?

Getting a regular health insurance to cover child birth in China is not an option any more. So let’s look at 2 options that are still available.

1 – get a medical insurance to cover medical expenses for anything not related to maternity. Most companies like Allianz and Now Health will even cover complications of pregnancy. Should anything go wrong during child delivery in China. This will also allow you to get your baby covered as soon as he/she is born. Refer to health insurance costs in China article to learn more what to expect when considering this.

2- get a maternity package from an international hospital in China. Whatever maternity package costs are, those are roughly 1:1 to carrying medical expenses out of pocket. More on that below.

Maternity Packages from International Hospitals for Foreigners in China

If you happen to live in Tier 1 or Tier 2 city in China, there are some very good international OBGYN hospitals. These facilities explicitly deal with giving birth in China, foreigners can look into those as an option for having baby. Very often those have already pre-set maternity packages that you can get once already pregnant. Keep in mind, it won’t cover complications should child for example be born pre-mature. Or require some treatment in ICU. This is what insurance is for. Maternity package mostly will still cover complications of birth related to mother. Which is still better than no cover at all, right. If you need help and discounts on arranging any of that please get in touch so we can help.

What hospital are good for giving birth in China as an expat?

Jiahui International Hospital in Shanghai has already become one of the most popular international hospitals for foreigners in Shanghai. They do also have their own fertility clinic. Through this they offer maternity package that currently goes for RMB 45,000 for traditional delivery and RMB 70,000 for c-section. More on this on Jiahui Hospital Shanghai

American Sino Hospital in Shanghai is another very popular option for expats on giving birth in Shanghai. Compared to Jiahui Health, they have much more options available as OBGYN is the core of their medical practice.

Delivery packages are ranging between RMB 45,000 and 90,000. Depending on how comprehensive you want it to be. They even have maternity packages just for pre or post natal only without child delivery. Those are somewhere in the range of RMB 5,000 and RMB 20,000. American Sino also partners with several smaller tier clinics such as Worldpath International Shanghai and help them with their client. In particular with Worldpath you can still undergo pre natal checks at there location in Lujiazui, but for giving birth (child delivery itself) they will arrange you a visit at American Sino’s facility in Xuhui hospital. American Sino Shanghai and Worldpath International Shanghai

Giving birth in Shanghai

United Family Shanghai Hospital offers various maternity packages too. Just pre-natal will run you for RMB 28,000 only. Traditional (vaginal) child delivery will be RMB 59,000 while if you get this together with pre natal then total will be only RMB 82,000 per package. Going further for section+pre natal will be coming towards RMB 111,000 price tag. On top of those they do also sell pre-conception, early pregnancy check up as well as late stage prenatal check up for foreigners giving birth in Shanghai. United Family Shanghai (UFH Shanghai)

Ferguson Health Shanghai (previously known as Read Leaf Hospital) is ready to help expats and foreigners with child delivery regardless how complicated it can be. Dr Ferguson is ready to provide you not only with maternity packages that range somewhere between RMB 40,000 and RMB 120,000 but also teaching classes on various different topics you might be interested about giving birth in China for expats. At some point they even used to provide pre natal yoga classes for you to get familia with body movements and restrictions during pregnancy. Ferguson Health Shanghai

Giving birth in Beijing

OASIS International Hospital Beijing. Giving birth in Beijing for expats, you definitely will come across this medical facility. It is one of the biggest and well equipped international hospitals in Beijing to assist you with having baby in China. Maternity packages range somewhere between RMB 45,000 and RMB 85,000. On the other hand, there is whole bunch of other things available too, such as pre natal packages on their own, as well as pre conception check ups. Those are one of the most comprehensive in the city, below are details. OASIS Hospital Beijing

AmCare Hospital Beijing will be a slightly cheaper version of OASIS. They do have less maternity packages available but are still able to provide routine delivery and pre natal checks. Such will cost around RMB 60,000. While for actual giving birth they will send you to a main hospital in Haidian district, regular ultrasounds and check ups can be arranged in any of the other 4 clinics across the city. AmCare Hospital Beijing

Beijing Antai Hospital. Those of us who are looking to have a water birth in Beijing have came across that medical facility on a number of forums. One of the very few places in capital that can arrange it. Additionally, very reasonably priced for such services. All of it will run you just a bit over RMB 35,000 for a package. Antai Hospital Beijing

Eden Hospital Beijing. Probably one of the biggest hospitals operating in downtown. Compared to regular players like OASIS or United Family they don’t employ as many foreign doctors. Pre natal check ups and giving birth in Beijing with them will cost you around RMB 60,000. Eden Hospital Beijing

Beijing United Family Hospital (BJU). When it comes to giving birth in China as an expat, United Family been on the market longest amongst other private medical facilities. Very similarly priced as Shanghai. Pre natal and regular giving birth in this hospital will cost you around RMB 83,000. Should you wish to switch to Caesarean section as a way to having a child then costs will be slightly above RMB 110,000 per package. United Family Beijing

Other cities

Raffles Medical is a huge chain of medical facilities across the entire Asia. In China they have hospitals and clinic in cities like Beijing, Shanghai, Nanjing, Chongqing, Tianjin, Chengdu and Shenzhen. While pre and post natal care will be available in all of them, only hospitals can help you with child delivery in China. Others will refer you to their partner local hospital which is still a good options because they will be the one arranging everything on your behalf. Raffles Medical China

Support from community when having a child in China

If you are particularly new to China and want to get some suggestion or hints from a fellow foreigners in the country regarding particular issues on giving birth in China then following links might be helpful. Major cities like Shanghai and Beijing have a relatively large expat communities where you can benefit from a local knowledge of a fellow expat. Shanghaimamas is one example of a community of local expatriate females sharing hints with each other on how to best handle their kids in the city.

ShanghaiFamily is another great resource of getting best knowledge of the local life from expatriates in the city. Beijing-Kids will be a similar online source for getting information about having children in China as a foreigner in case you live in the capital. EasyExpat and ExpatArrivals are rather general forum based websites where expats and foreigners can ask questions to be answered by other expats, those are not limited to a particular city but rather cover China nationwide.

Key partners they rely on when servicing and underwriting their plans are AXA and MAI (Medical Administrators International), last one being the third party agent responsible for claims and direct billing under the plan. A+ is one of the very few companies that covers Traditional Chinese Medicines in full up to the limits of the plan. Most their plans don’t have limit on outpatient care which is what same clients prefer about them.

Key partners they rely on when servicing and underwriting their plans are AXA and MAI (Medical Administrators International), last one being the third party agent responsible for claims and direct billing under the plan. A+ is one of the very few companies that covers Traditional Chinese Medicines in full up to the limits of the plan. Most their plans don’t have limit on outpatient care which is what same clients prefer about them.